Audit Training

Certification - Level 3 - In-Charge/ Senior

A series of courses designed for Auditors with some practical experience on audits and are moving into an engagement supervision role; qualifies for two regulatory ethics credits and 29.5 CPE credits.

Purchase Certification:

Certificate Highlights

The transition from staff auditor to performing more complex audit procedures and assuming more responsibility handling financial reporting issues. Understand how to properly safeguard independence when performing both attest and non-attest services. Learn how to alter the nature, timing, and extent of audit procedures to be commensurate with the assessed risk of material misstatement. Learn how to ensure quality control of the engagement and better manage the client. Case studies and exercises are used to reinforce key points.

Learning Objectives:

- Describe accounting, auditing and other attest issues important to a public accountant.

- Explain best practices for complying with professional, technical, and regulatory requirements related to common A&A issues faced by public accountants.

- Apply examples and illustrations to “real-life” circumstances encountered in financial statement audits.

Frequently Asked Questions

FAQs

Why should I be Illumeo Certified?

Why should I hire a Professional with an Illumeo Certification?

What happens if I fail the exam?

Why would I want a subscription on Illumeo?

Instructor

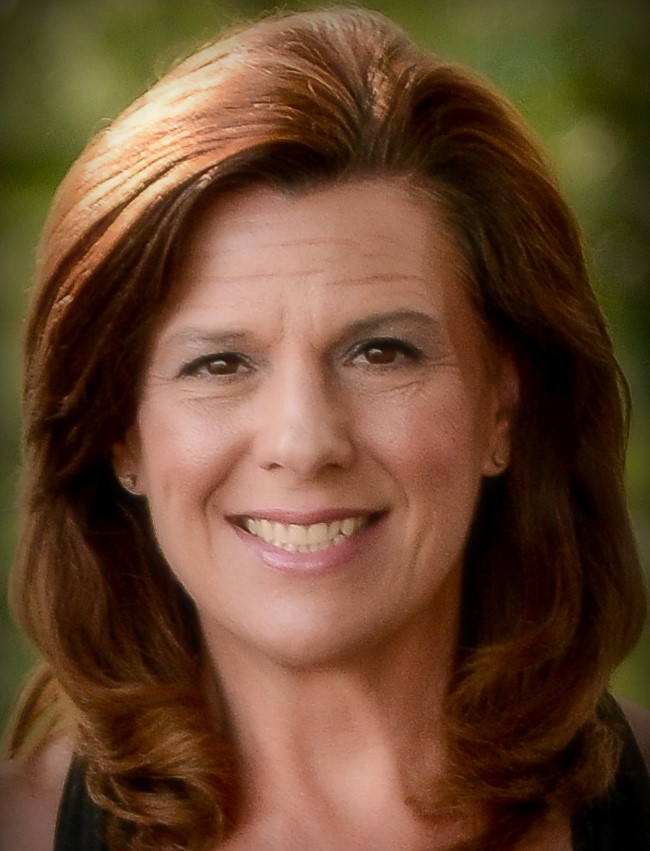

Jennifer F. Louis

CPA, President of Emergent Solutions Group LLC

Jennifer F. Louis has over 25 years experience in designing and instructing high-quality training programs in a wide variety of technical and “soft skills” topics needed for professional and organization success. In 2003 she founded Emergent Solutions Group, which is dedicated to meeting organization’s professional training needs. Jennifer serves a wide variety of clients, including public accounting firms, state CPA societies, private industry corporations, and public sector agencies.

13 Courses