International Financial

Reporting Standards (IFRS) Certification

This program explores special accounting, reporting, and disclosure topics to ensure the preparation and fair presentation of financial statements under IFRS.

Purchase Certification:

Certificate Highlights

The Certificate in IFRS course provides an overview of International Financial Reporting and International Financial Reporting Standards (IFRS). It covers regulatory history of International Accounting Standards Board's (IASB); from its beginnings through recent updates and improvements, as well as future advancements.

International Financial Reporting Standards (IFRS) are developed and maintained by the International Accounting Standards Board (IASB). Like GAAP, the overriding requirement of IFRS is to fairly prepare and present financial statements. This certification Program begins with an overview of the conceptual framework and other significant general considerations applied in the preparation and fair presentation of IFRS financial statements.

This IFRS certificate program, helps enrollers to understand primary differences between full IFRS and IFRS for SMEs and U.S. GAAP. We also explain the latest updates to full IFRS that have recent, current, or future effects.

Training of this online IFRS certificate program;

- Present an overview of general considerations when fairly preparing financial statements and the most significant elements of the new five-step model to determine when and what amount to revenue recognition in a contract with a customer.

- Address the proper accounting treatment for both current and deferred income taxes and the most important considerations in accounting for short-term employee benefits (like paid absences), defined contribution plans, defined benefit plans, and other employee benefits.

- Highlight the IFRS accounting and financial requirements of leases, financial instruments, nonfinancial assets (such as property, plant, and equipment, investment property, intangible assets, and inventories), and more!

- Discover how business combinations under IFRS standards are accounted for under the acquisition method, with limited exceptions, including a look at the step-by-step method for properly accounting for business combinations, which includes calculating goodwill or a bargain purchase gain per IFRS 3.

- Study IFRS 10 (Consolidated Financial Statements), which provides guidance for entities that are consolidated. We explore when it is appropriate to apply each of the accounting methods for investments in other entities, and the resulting financial statement implications.

- Highlight various issues encountered for the proper accounting and reporting of share-based payment awards per IFRS 2, followed by an overview of the most challenging requirements to understand and apply for hedge accounting under International Financial Reporting Standard (IFRS) 9.

- Explores special accounting, reporting, and disclosure topics to ensure the preparation and fair presentation of financial statements under IFRS.

Frequently Asked Questions

FAQs

Why should I be Illumeo Certified?

In short, you would do this to get better at what you already do, or to get a significant knowledge jump on something you want to do for a living. And, via the certificate itself, to be able to show others that you have attained this knowledge.

Why should I hire a Professional with an Illumeo Certification?

You would hire this Professional because they bring deep knowledge, on concrete topics, to your team. Simply completing the Illumeo certification denotes that the person is a serious professional willing to take the time to become very good at what they do, and that they put in the time, passed the tests, and are knowledgeable in their area of certification.

What happens if I fail the exam?

There is an exam for every course and you must pass every one in order to receive your certification. You may re-study the content and re-take any exam until you pass it.

Why would I want a subscription on Illumeo?

A subscription to Illumeo helps fill out your professional knowledge with its unfettered access to hundreds of up-to-date on demand courses taught by long-time practitioners - just like the instructor of this certification program.

Instructor

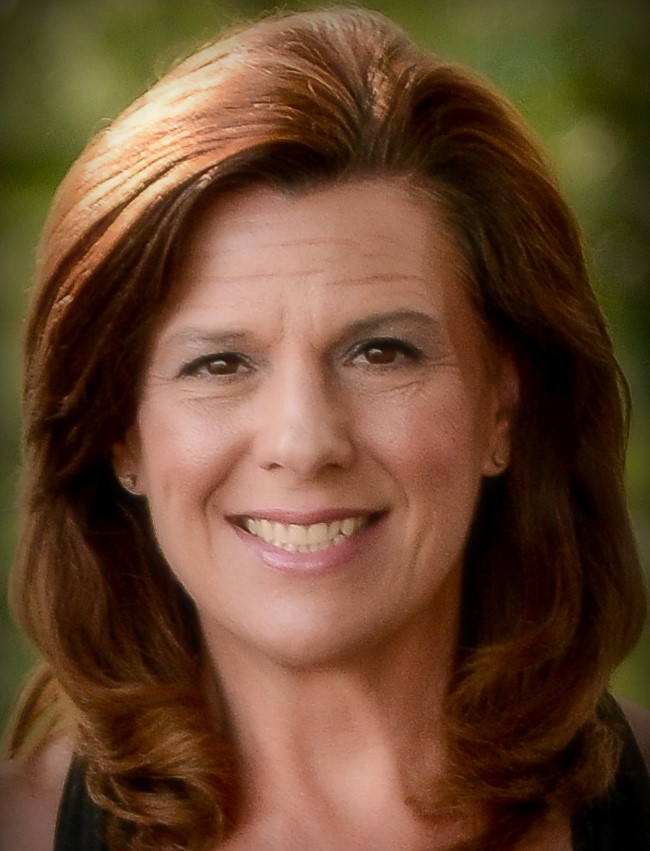

Jennifer F. Louis

CPA, President of Emergent Solutions Group LLC

Jennifer F. Louis has over 25 years experience in designing and instructing high-quality training programs in a wide variety of technical and “soft skills” topics needed for professional and organization success. In 2003 she founded Emergent Solutions Group, which is dedicated to meeting organization’s professional training needs. Jennifer serves a wide variety of clients, including public accounting firms, state CPA societies, private industry corporations, and public sector agencies.

16 Courses