Certified Government

Financial Manager

Financial Manager

417 Illumeo Courses Webinars meet the Association of Government Accountants (AGA) Certified Government Financial Manager (CGFM) CPE program criteria.

Illumeo CPE courses have been developed according to NASBA and state requirements for CPAs for all 50 states. However, you should contact the AGA if you have any questions concerning their CPE requirements as they do not "pre-approve" specific platforms or courses for AGA credit.

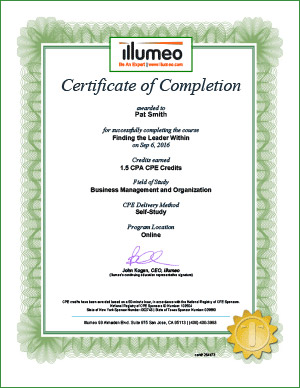

Your Illumeo CPE certificates and credits are managed through your certificate dashboard which is available when you are logged in to your account. Certificates can be downloaded as pdfs or you can email them to yourself at any time. All CPE credits earned through Illumeo will be available through this dashboard.

Illumeo is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State Boards of Accountancy have the final authority on the acceptance of individual course for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website:

www.nasbaregistry.org

CGFM CPE Criteria

Quoting directly from the AGA website: To determine if programs contribute to professional proficiency and to facilitate documentation, the following criteria for CPE programs may be considered as appropriate.

For both group and individual/self-study programs:

- An agenda or outline is prepared in advance and retained by the program sponsor that indicates the name(s) of the instructor(s); the subject(s)/topic(s) covered; the date(s) and length of the program; and, when appropriate, the program's learning objectives and any prerequisites.

- The program is developed by individuals qualified or experienced in the topic/subject matter.

- Program materials are technically accurate, current and sufficient to meet the program's learning objectives.

- The program is reviewed, when appropriate, by other qualified or experienced individuals. The nature and extent of any review may vary depending on characteristics of the program.

- Evaluations of the program are obtained from instructors and participants, when appropriate

For group programs:

- Attendance records are maintained.

- The program is presented by a qualified instructor or discussion leader.

For individual/self-study programs:

- The program sponsor provides evidence of satisfactory completion (a certificate or transcript).

- Participants are required to register for the program.

Qualified Training

The following programs and activities qualify for CPE hours, provided they are in acceptable topics and subjects:

Group programs such as:

- Internal training programs (courses, seminars and workshops). Note: Programs conducted by the employer of the individual must provide for an instructor or course leader. There should be formal instructional and training material. On-the-job training does not qualify.

- Education and development programs presented at conferences, conventions, meetings, seminars and workshops of professional organizations.

- Web-based seminars and structured programs of study.

Individual study programs such as:

- Web-based courses.

- Courses given through Internet webcasts, televised presentations, DVD, CD-ROM, audio cassette tapes, videotapes and computer programs.

CPE Topics and Subjects That Qualify

The CGFM is initially responsible for determining whether a topic or subject qualifies as acceptable CPE. CPE programs include a wide variety of topics and subjects that may contribute to maintaining or enhancing the professional proficiency of some CGFMs, but not others. Determining what topics and subjects are appropriate for individual CGFMs to satisfy the CPE requirement is a matter of professional judgment. Among the considerations in exercising that judgment are CGFM's experience, the government financial management area(s) in which they work and the responsibilities they assume in performing government financial management functions.

To help one determine whether the course would qualify for CPE, the CGFM should answer “yes” to all of the following questions:

- Is the information covered in this course applicable to government financial management?

- Does this course contribute to my professional proficiency as a CGFM?

- Does this course provide information that directly benefits me in my job as a government financial manager or enhance my overall knowledge of government financial management?

CPE that would satisfy the CGFM Program's requirement must be in government financial management topics or related technical subjects applicable to government financial management. Examples of such topics and subjects include, but are not limited to, the following:

accounting principles and standards, accounting research, accounting systems, acquisitions management, actuarial techniques and analysis, analytical procedures, assessment of internal controls, assessment and evaluation methodologies, asset management, audit methodologies, audit of contract compliance/costs, audit/evaluation of program results, audit risk and materiality, audit/evaluation standards, audit documentation preparation and review techniques and tools, auditing research, budgeting, business law, cash management, compliance with laws and regulations, compilation and review of financial statements, computer science, computer security, contracting and procurement, cost accounting, credit management, current industry risks, data management and analysis, debt collection, economics, enterprise risk management, ethics and independence, evaluation design, financial auditing, financial management, financial management systems, financial planning or analysis, financially related fraud, financial reporting, financial statement analysis, forecasts and projections, forensic accounting, forensic auditing, government structure, organization and authority, human capital management, industrial engineering, information resources management, information systems management, information security, information technology, internal control and internal control assessment, interviewing techniques, inventory management, investigations, investment of public funds, operations research, oral and written communications, organizational change management, pension and other employee benefits accounting, performance measurement and reporting, performance improvement, principles of leadership, management and supervision, process reengineering, procurement management, productivity improvement, program evaluation, project management, property management, public accountability, public administration, public finance, public policy and structure, report writing, research methods, sampling methods, social and political sciences, statistics, statistical analysis and techniques, strategic planning, and taxation (see note below).

Some courses, such as the ones that cover individual or business taxation, may not qualify for the CGFM CPE. If the CGFMs are taking these courses to satisfy the CGFM requirement, they will need to make a connection to their job and proficiency as a government financial manager and be prepared to provide a written explanation of the applicability of such courses.

Measuring CPE hours

A CPE hour may be granted for each 50 minutes of participation in programs and activities that qualify. One-half CPE hour increments (equal to 25 minutes) may also be granted after the first CPE hour has been earned in a given program or activity (50 minutes in the minimum number for any given program). At conferences and conventions where individual presentations are less than and/or more than 50 minutes, the sum of the presentations should be considered as one total program. For example, two 90-minute, two 50-minute and three 40-minute presentations equal 400 minutes or eight CPE hours. When the total minutes of a presentation are more than 50, but not equally divisible by 50, the CPE hours must be rounded down to the nearest one-half hour.

Required CPE hours

80 CPE hours must be completed within the CGFM’s two-year CPE cycle. The first CPE cycle starts on Jan. 1 of the year following the one when the CGFM designation was earned. For example, if the CGFM was awarded any time in 2014, the first CPE cycle starts on Jan. 1, 2015 and ends on Dec. 31, 2016. See Calendar of CPE cycles for a schedule of CPE cycles. The CPE requirements apply to all active CGFMs, whether employed or not, and whether employed full- or part-time by a government or other organization. Active CGFMs must complete a minimum of 80 CPE hours every two years to maintain their CGFM certification. While there is no minimum number of hours required to be earned each year, CGFMs are encouraged to earn CPE hours throughout their two-year cycle.

Additional requirements may apply. You can review the specific CGFM CPE requirements on the ASA web site.